Diving Deep into the Specialty Steel Industry with Vardhman Special Steels Limited

Exploring the Strengths, Challenges, and Future Pathways of VSSL

Hey there, finance aficionados and equity enthusiasts! Buckle up because this blog is a deep dive into the specialty steel industry, specifically through the lens of Vardhman Special Steels Limited (VSSL). Yes, it’s long, but just like a good Netflix series, it’s worth every minute of your time. So, grab your favorite beverage, settle in, and let’s embark on this enlightening journey. And if you find yourself tangled in technical jargon about steel making, just remember: the appendix is your trusty glossary, like the subtitles for that complex sci-fi movie you love. Happy reading!"

Index

1. Introduction to Automotive Specialty steel industry

2. Vardhman Special Steels Limited: An Overview

3. Products

4. Manufacturing Method – A Major Edge Over Its Peers

5. Understanding the Specialty Steel Industry

6. Strategic Collaboration with Aichi Steel

7. Expansion And Strategic Growth Targets

8. A Key Opportunity For Growth And Improved EBITDA Per Ton By Exports

9. Competitive Landscape

10. Management and corporate governance and culture

11. Conclusion

Introduction to the Automotive Specialty steel industry

The specialty steel industry is a critical segment of the broader steel industry, characterized by its production of high-grade steel used in demanding applications. Unlike regular steel, specialty steel boasts superior properties due to the precise addition of alloying elements such as chromium, nickel, molybdenum, vanadium, and tungsten. These elements enhance the steel's performance, making it suitable for various industrial applications, including automotive, engineering, tractor manufacturing, and bearing production. Currently, the Indian specialty steel manufacturers are majorly producing automotive-grade specialty steel and our target player (VSSL) is one of the top 3 specialty automotive steel manufacturers in India.

Market Dynamics

The specialty steel market is complex and highly competitive, driven by technological advancements and stringent performance requirements. Here are some key aspects:

Market Size and Scope: The market size for automotive steel in India ranges from 7 to 8 million tons annually as per the management of VSSL although it is hard to point at the exact figure.

Localized Production: The industry predominantly consists of localized manufacturers with minimal imports, especially in the categories produced by VSSL. This localization helps in reducing dependency on foreign sources and ensures a stable supply chain.

Pricing Dynamics: Automotive specialty steel manufacturers often face limited price negotiation power with Original Equipment Manufacturers (OEMs), who typically dictate pricing. Market contracts generally follow a six-month cycle, though volatility can lead to quarterly contracts, which are preferred by manufacturers to better manage costs and pricing fluctuations. Specialty steel manufacturers are trying to come up with a formula-based system to avoid ambiguity.

Vardhman Special Steels Limited: An Overview

Incorporation and Evolution:

Incorporated in 2010, VSSL is a part of the Vardhman Group. Situated in Ludhiana, Punjab, VSSL manufactures hot rolled bars catering to various sectors. The company's transformation post-2010 under the leadership of Sachit Jain is noteworthy. Initially (before 2010), VSSL had good systems, quality, and customer reputation, but lacked in maintenance and electrical systems.

VSSL's journey from its inception to becoming a leading player in the specialty steel industry is marked by strategic initiatives and continuous improvements. The company's focus on quality, customer satisfaction, and operational efficiency has been instrumental in its growth.

Key Developments Post-2010 – This is the year when VSSL got its new Managing Director

The strategic initiatives and technological upgrades undertaken since 2010 as fresh capital was chipped in significantly enhanced VSSL's operational capabilities and market position:

2013: Installation of a fully automatic rolling mill with a capacity of 150,000 metric tonnes and advanced testing systems.

2015: Implementation of fume extraction systems to enhance the plant environment.

2019 & 2022: Technical assistance agreements with Aichi Steel, Japan, to develop special steel grades and reduce manufacturing costs.

These developments have not only increased production capacity but also improved product quality and operational efficiency. The collaboration with Aichi Steel, in particular, has been a game-changer (discussed in detail later), bringing in advanced technologies and best practices from one of the world's leading steel manufacturers.

Some more remarkable operational Improvements post-2010 include

VSSL has made remarkable strides in operational efficiency and technological advancements, including:

Daily Production Increase: Increased daily heats from 8 to 18, significantly boosting productivity.

Raw Material Optimization: Enhanced raw material mix by eliminating sponge iron and reducing imported scrap, resulting in cost savings and improved quality.

Power Efficiency: Significant improvements in power factor and sequence sheet optimizations have led to more efficient energy usage and cost reductions.

VSSL's commitment to continuous improvement is evident in its operational strategies. By optimizing production processes and adopting innovative technologies, the company has achieved substantial gains in efficiency and productivity.

Products

The majority portfolio is for Passenger vehicles followed by 2-wheelers

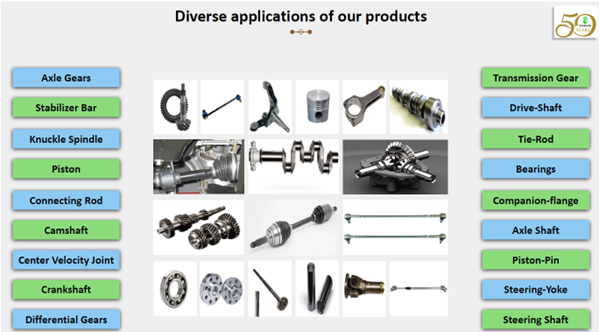

VSSL makes automotive steel which goes in the forging industry and then goes in moving parts like gears, connecting rods, spins

Final output for VSSL which is shipped to a forging plant are Steel Bars and Rods and Bright Bars (Refer to the appendix section to understand the technical details)

Following is the Client Portfolio of VSSL:

VSSL's client portfolio is impressive, with approximately 25% of its volume sales directed to its top four largest clients, all of whom are major Original Equipment Manufacturers (OEMs). One notable development is VSSL's progress in gaining approvals from European OEMs, including some products designed specifically for electric vehicles (EVs). Although the names of these OEMs remain undisclosed, these initial approvals are a promising step toward expanding VSSL's footprint in the European market. Currently, the EV segment accounts for about 7% to 8% of VSSL's portfolio, but with these new approvals, this percentage is set to rise, further solidifying VSSL's position in the evolving automotive industry.

Manufacturing Method – A Major Edge Over Its Peers

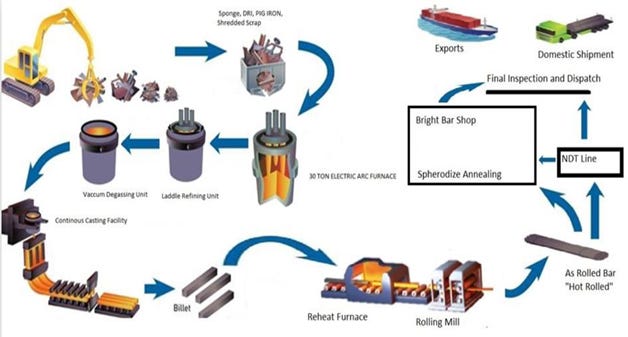

Following is the whole process of steel manufacturing by Electric Arc Furnace (EAF)

VSSL's commitment to sustainability is evident in their choice of manufacturing technology. Unlike their competitors, Sunflag and Mukand, who use the traditional Oxygen Blast Furnace method, VSSL employs an Electric Arc Furnace (EAF). (Refer to the appendix section for technical details). This decision not only enhances efficiency but also significantly reduces the carbon footprint. While competitors generate between 2.75 to 3 tons of carbon per ton of steel, VSSL's EAF method produces just 0.9 tons of carbon per ton of steel. This environmental impact is set to improve further, dropping to 0.4 tons once the company sources electricity from renewable sources.

The use of scrap steel in the EAF process is another environmentally friendly choice, as opposed to the oxygen blast furnace method. The cost-effectiveness of this approach is linked to the prices of scrap steel, making it a strategic decision for VSSL.

Participation in the Circular Economy of Scrap: VSSL is actively participating in creating a circular economy for scrap. For instance, OEMs like Maruti are planning scraping plants that will contribute to this sustainable practice.

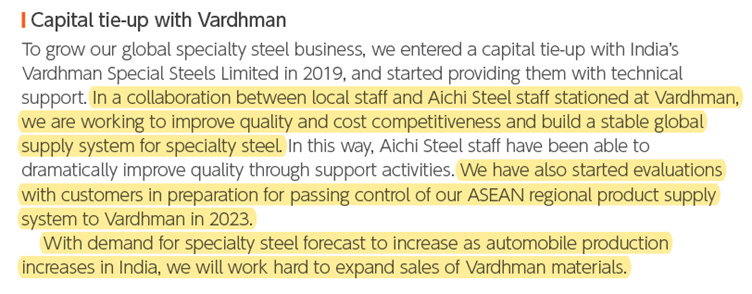

A snippet from Aichi Steel Corp's integrated report highlights the significance of these sustainable practices, reinforcing VSSL's commitment to environmental stewardship and operational excellence. By focusing on innovative and eco-friendly manufacturing methods, VSSL is setting new standards in the specialty steel industry in India being at par with international standards.

Strategic Collaboration

This strategic alliance initially attempted in 2014, faced challenges but found its footing in 2020. In November 2019, VSSL signed a Technical Assistance Agreement with Aichi Steel Corporation (ASC). This agreement included the issuance of equity shares on a preferential basis worth Rs. 50 Cr. The strategic move resulted in Aichi holding an 11.4% stake in VSSL, achieved by issuing shares at Rs. 108, a 25% discount from the market price of Rs. 144. This step, although significant, was deemed fair to minority shareholders. Moreover, Aichi appointed an Additional Director to represent them, and their staff has been physically stationed at VSSL, facilitating a seamless integration of expertise and operations.

Aichi Steel, a renowned player in the industry, believes it takes nine years to master the production of special steel. VSSL, having spent four years in collaboration with Aichi, is on a promising trajectory. By the end of March 2023, VSSL commenced mass production of steel for Aichi Steel Corporation’s forging companies in Southeast Asia. With approvals received for specific grades, the company targets exports of about 7,000 to 8,000 tons to Aichi Forge in the region.

Why was there a need for a Japanese Partner and not someone else?

The rationale behind partnering with a Japanese firm like Aichi is multifaceted. The Vardhman Group has historically had positive experiences with Japanese companies, and the Indian market is predominantly driven by Japanese automakers such as Maruti, Toyota, Nissan, and Hero Honda. This strategic alignment enhances VSSL’s market position and opens up new avenues for growth.

Capital Infusion and Future Plans by Aichi

Currently, Aichi holds an 11.4% stake in VSSL but there are plans to potentially increase this to 20-25%. This capital infusion is aligned with Aichi's strategic planning, typically conducted in three-year cycles. As of FY 23 March, VSSL was in the middle of the second three-year plan. The likelihood of an announcement regarding increased stakeholding is high within the ongoing three-year plan, contingent upon Aichi’s satisfaction with the planned operational transitions, expected to conclude by FY 26 or earlier. An estimated capital infusion in FY 2025 is projected to support greenfield expansion, though this expansion is not the primary reason for the infusion as the amount can approximately be close to 100-150 crores only.

Significance of the Alliance

Here is a snip from Aichi’s annual integrated report.

The collaboration with Aichi Steel brings significant technological and operational advantages. Aichi’s in-house R&D, closely aligned with Toyota, means VSSL can leverage this expertise to secure more approvals from Maruti Suzuki and Toyota. This is a strategic advantage not typically seen with other peers in the industry.

VSSL has also embraced Aichi's work culture, which prioritizes safety, quality, productivity, and cost in that order. This approach has led to tangible improvements in operational efficiency. For instance, VSSL recently increased its steel melting shop capacity to 260,000 tons in December FY 23, up from 240,000 tons in March FY 23. The reasons for this enhancement were detailed in the December 2023 conference call, highlighting improvements in scrap mix and operational efficiencies such as reduced power-on and power-off times for the furnaces. These measures allow for more operational time from the furnaces, resulting in an increased number of heats per day.

A Unique Advantage

The alliance with Aichi is distinguished by its strong participative nature. Unlike other companies, VSSL’s alliance with Aichi involves the direct involvement of Aichi personnel at VSSL, collaborative sales efforts, and crucial approvals from major Japanese Original Equipment Manufacturers (OEMs) like Toyota. As mentioned by Sachit Jain, “To the best of my knowledge, none of the other companies have got a major approval by a Japanese OE for overseas business. We have got from Toyota. And we should be getting from another OE in the next 6 months to 8 months, a global approval.” This strategic partnership with Aichi Steel not only solidifies VSSL’s position in the specialty steel market but also sets it apart from its competitors. By leveraging Aichi's technological expertise, operational insights, and strong market presence, VSSL is well-positioned for sustained growth and innovation in the years to come.

Expansion And Strategic Growth Targets

The company has tackled bottleneck challenges by enhancing its manufacturing plant with equipment enhancements.

The company is considering expansion at its Ludhiana factory and planning a new plant with a capacity of 500,000 to 600,000 tons, targeting operational readiness post FY 29 which can be a game changer.

Strategic targets for FY 2024 to FY 2026 include:

Exploring outsourcing with OEM-approved manufacturers at reduced margins.

EBITDA per ton target: 8000 to 11,000 initially, aiming for 10,000 to 12,000 in subsequent years.

Achieved FY 24 sales target of 230,000 tons despite production wastage.

Focus on securing Toyota approvals, targeting 30,000 tons sales to Toyota and 25% export target (approx. 50,000 tons) by FY 24.

How does VSSL plan to finance its greenfield expansion?

Potential investments from Aichi and other stakeholders.

Consideration of Qualified Institutional Placement (QIP) and internal financing.

Leveraging VSSL's low-debt status and financial backing from the Vardhman group, which aims to maintain its stake in VSSL.

A Key Opportunity For Growth And Improved EBITDA Per Ton By Exports

Company exports share of sales is around 10% till Sep FY 23 and plans to increase the same to 20% to 30% in two to three years with a major push by export to Aichi. This will improve their realization.

FY 23 con call state “I think at this moment, our major export is in Thailand only because Thailand has lot many forging hub. So that is our first target. Plus our partner, Aichi, has a major forging plant in Thailand, and Indonesia, so in this region only. However, now we are making efforts and exploring the markets of Europe also. But at this moment, we are concentrated in Thailand because Thailand is offering us the opportunity to grow.”

The overall requirement of Aichi for the Southeast Asia region is as high as 200,000-400,000 tons as per VSSL and VSSL is targeting approx. 30000 tons by FY 2027

Competitive Landscape

VSSL operates in a fiercely competitive market with around 15 significant players in the automotive specialty steel industry however their key competitors include:

Sunflag Iron and Steel Co. Ltd (.: Known for its high-quality alloy and special steels, Sunflag is a formidable competitor.

Mukand Ltd.: Another major player (largest in capacity), Mukand offers a wide range of specialty steel products.

Other Competitors: JSW Steel, Tata Long Products, Jaiswal, Nikko, and SLR also contribute to the competitive landscape, each with its unique strengths and market positions.

As mentioned already VSSL has a significant advantage over its peers due to its EAF method of manufacturing and highly competent management with better efficiency.

Management, corporate governance and culture

Sachit Jain – holds a 14% stake in VSSL and intends to not sell any: Mr. Sachit Jain is the Vice - Chairman/ Managing Director, of Vardhman Special Steels Ltd. He studied Electrical Engineering at IIT, New Delhi, Management at IIM, Ahmedabad, and Financial Management at Stanford, USA. He was awarded a gold medal at IIM, Ahmedabad in 1989. Before joining Vardhman Group in 1990 as Executive Director, he started his management career with Hindustan Lever in 1989.

He has helped shape Vardhman's investment in Baddi, Himachal Pradesh, India right from the beginning. Starting with an initial investment of Rs 32 crores he has led the team which put up 9 factories with a cumulative investment of approximately Rs. 1500 crores and a direct employment of over 7000 people. After the stabilization of the manufacturing operations of the Group in Himachal Pradesh, he shifted to the Vardhman Group Corporate Office in Ludhiana to help the Group's overall operations in different businesses

In 2010, he took charge of Vardhman Group’s steel division- Vardhman Special Steels Ltd. as the Vice-Chairman/ Managing Director. He transformed the culture of the steel division into a growth-oriented company, installed a new rolling mill, and helped to improve the productivity in the Steel Melting Shop which led to a significant increase in production from 60,000 tons to 170,000 tons. Under his leadership, the company’s turnover grew from 250 Cr to 1100 Cr.

Website: http://jainsachit1.blogspot.com/

Saumya Jain is the daughter of Sachit and Suchita Jain

Q1 FY 24 con call - “She's fully involved in the business and involved in all functions and particularly focusing on HR and Strategy and our relationship with Aichi, which is the most important part of the strategy going ahead”

Mr. Rajendra Kumar Rewari: Ex-employee of Vardhman group. Morarjee Textiles is not a financially viable entity.

Corporate governance

The Company is not institutionalized

News: No bad media

Related party transactions: No concerning RTP

Royalty consideration: Royalty paid for FY 23 to Aichi Steel amounts to 7.89 cr which is 7.85% PAT which seems high.

Salary drawn by management and family is significant, approx. 19% of PAT in FY 23

5 Independent Directors within a total of 12 Directors which is moderate and not excellent. Rajender Kumar Jain is father of CEO Sachit Jain and seems to be not a fit for the position.

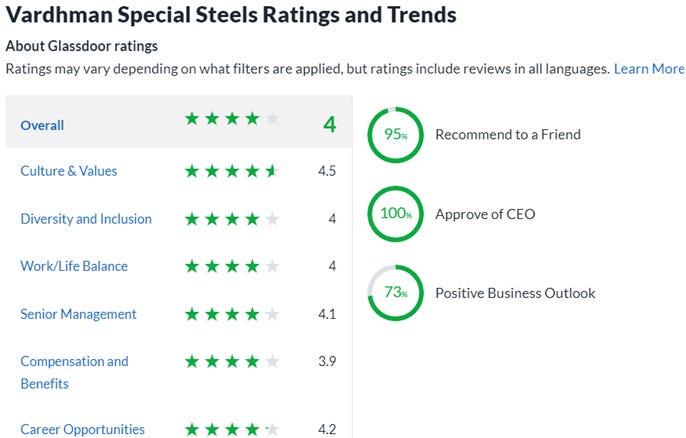

Employee Satisfaction and Culture

In the realm of employee feedback on platforms like Glassdoor, this employer stands out prominently. They notably refrained from any layoffs during the challenging period of Covid-19, earning considerable praise and loyalty from their workforce. Metallurgists, engineers, and marketing officers alike have expressed satisfaction, highlighting positive experiences with the company's management and work environment. These testimonials underscore a workplace culture that values stability, professional growth, and employee well-being.

Risks and their Mitigation

VSSL's investor presentation provides a detailed list of its product offerings (shown in the products section), highlighting a significant point: most of these products are not utilized in electric vehicles (EVs).

This transition poses both challenges and opportunities for VSSL. While the EV market share of VSSL sales was about 6% in FY 22, primarily in the passenger vehicle segment, the management remains optimistic. Despite battery plug-in EVs requiring 30%-40% less steel, there is still a substantial market for steel suppliers. The company is proactive in mitigating risks associated with the EV transition by planning a second new steel plant (greenfield expansion). This plant will be flexible and capable of producing different types of special steel, catering not just to the automotive sector but to other industries as well.

Mitigating the EV Risk:

VSSL is well-prepared to adapt to the evolving market demands. The management has emphasized their readiness to pivot as needed, as demonstrated in their March 2022 conference call: "It does not matter to us which segment does well or not as long as we are in the segments which are growing fast and we will participate in the growth. So if EV grows, we will grow. We are pretty well positioned in that state."

Significance of EV Transition:

The EV transition is notably high in the two-wheeler segment, where penetration shows significant potential. However, for a steel maker like VSSL, adjusting the product range to meet new requirements is not a major challenge. As highlighted in the September 2023 conference call, the management stated, "Maruti has already announced the doubling of their capacity. So even if EVs come in and there is a proportion of EVs higher than what we estimate, the need for special steel in India is still going to increase significantly in the next seven years."

Key Man Risk and Group Involvement:

The presence of Mr. Sachit Jain is crucial for VSSL, representing a key man risk if he is not involved in the business. Additionally, the involvement of the Vardhman Group in the business also presents risks that need careful management.

Conclusion

In conclusion, Vardhman Special Steels Limited stands out as one of the best automotive steel companies, thanks to its strategic leadership with Aichi, Environment-friendly manufacturing process, and focus on improving efficiency. The company has successfully navigated the challenges of the specialty steel industry and positioned itself for future success. However, it is important to acknowledge the key man risk associated with the pivotal role of Sachit Jain. Ensuring a robust succession plan and effective management strategies will be crucial for VSSL's continued growth and stability.

If you've made it this far, congratulations! You're now well-versed in the world of specialty steel and the remarkable story of VSSL.

Appendix Section (An Explainer To Technical Jargon in Steel Making Industry)

Automatic rolling mill

A fully automatic rolling mill, also known as an automatic rolling mill or automated rolling mill, is a highly advanced and technologically sophisticated facility used in the metalworking industry, particularly in steel and aluminum production. It is designed to handle the entire rolling process with minimal human intervention, ensuring high efficiency, precision, and consistency in the production of rolled metal products like sheets, coils, bars, and profiles.

Here are some key features and aspects of a fully automatic rolling mill:

Automation and Control Systems: The hallmark of a fully automatic rolling mill is its extensive use of automation and control systems. Advanced computerized control systems manage various aspects of the rolling process, including speed, temperature, pressure, and material handling.

Continuous Operation: Fully automatic rolling mills are designed for continuous operation, minimizing downtime and maximizing production throughput.

Rolling Process: The rolling process involves reducing the thickness of a metal ingot or slab by passing it through a series of rolling stands. The automated system controls the gap between the rolls, ensuring precise thickness reduction and shape control.

Material Handling: Automatic systems are used for material feeding, positioning, and removal, reducing the need for manual labor. Robots or conveyors are often employed to handle and transport the metal between various stages of the rolling mill.

Roll Cooling and Lubrication: Cooling and lubrication systems are automated to maintain the proper temperature and reduce wear on the rolls, enhancing the quality of the finished product.

Quality Control: Inline sensors and monitoring devices continuously measure various parameters such as thickness, temperature, and tension to ensure the quality and consistency of the rolled product.

Profile and Shape Control: Advanced rolling mills can also control the shape and profile of the final product, allowing for the production of a wide range of shapes and sizes.

Energy Efficiency: Fully automatic rolling mills are often designed with energy-efficient features to minimize energy consumption and operating costs.

Safety Systems: Safety features are integrated into the automation systems to protect operators and prevent accidents.

Maintenance and Diagnostics: Automated rolling mills often include diagnostic tools and predictive maintenance features to identify and address issues before they cause significant downtime.

Integration with Downstream Processes: These rolling mills can be seamlessly integrated with other downstream processes like annealing, coating, and packaging to create a fully automated production line.

Customization: Manufacturers can customize fully automatic rolling mills to meet specific production requirements, such as producing different grades, sizes, and types of rolled metal products.

Fully automatic rolling mills are crucial in industries where high-volume production, precision, and consistency are paramount. They play a vital role in manufacturing a wide range of metal products used in construction, automotive, aerospace, and various other industries. The automation and advanced control systems in these mills help improve productivity, product quality, and overall operational efficiency.

Ladle Refining Furnace (LRF)

A Ladle Refining Furnace (LRF) is a crucial equipment in the steelmaking process, specifically in secondary steelmaking. It is used to improve the quality of steel by removing impurities and adjusting its composition and temperature before casting it into final products. The Ladle Refining Furnace is typically positioned between the primary steelmaking process (such as a basic oxygen furnace or an electric arc furnace) and the continuous casting machine

Sequence sheets

In steelmaking, "sequence sheets" refer to documents or records that outline the sequence of operations or steps involved in the steelmaking process. These sheets are crucial for ensuring that the steel production process proceeds in an organized and efficient manner. The specific content and format of sequence sheets may vary depending on the steelmaking method and the specific processes involved. Sequence sheets are essential documents in steelmaking facilities as they help operators and technicians follow a standardized procedure, minimize errors, and optimize the efficiency of the steel production process. They also serve as valuable records for troubleshooting issues, analyzing process performance, and implementing continuous improvement initiatives

Bright bars & rods vs. steel bars & rods

Bright bars are distinguished by their superior surface finish, dimensional accuracy, and suitability for precision applications

Extra steps for Bright bars:

Cold Drawing: The next step in producing bright bars involves cold drawing. Cold drawing is a cold working process where the hot-rolled bars are pulled through a series of dies with decreasing diameters. This process reduces the diameter and imparts a smooth, bright, and polished finish to the surface. It also improves dimensional accuracy and mechanical properties.

Annealing: In some cases, the cold-drawn bars are subjected to an annealing process. Annealing involves heating the bars to a specific temperature and then slowly cooling them to relieve any stresses created during the cold drawing process. This can further improve the mechanical properties of the bright bars

The term "number of heats that can be casted"

typically refers to the quantity of molten metal that can be poured and cast into molds or used in a casting process in a given time period. In the context of metal casting, a "heat" is a specific batch of molten metal that is prepared and poured into molds to create castings. The number of heats that can be cast is a crucial factor in production planning and efficiency, as it determines the output or throughput of a casting facility or process.

For example, in a steel foundry, the number of heats that can be cast per day or per hour would indicate how many batches of molten steel can be produced and used for casting operations during that time. The capacity of the furnace, ladle, and casting equipment, as well as the size and complexity of the castings being produced, will influence the number of heats that can be casted within a given timeframe.

A fully automatic rolling mill

A fully automatic rolling mill, also known as an automatic rolling mill or automated rolling mill, is a highly advanced and technologically sophisticated facility used in the metalworking industry, particularly in steel and aluminium production. It is designed to handle the entire rolling process with minimal human intervention, ensuring high efficiency, precision, and consistency in the production of rolled metal products like sheets, coils, bars, and profiles.

EAF vs Oxygen blast furnace methods

Electric Arc Furnace (EAF):

Operation: EAFs use an electric arc to melt scrap steel or direct reduced iron (DRI) into liquid steel. The arc is created between graphite electrodes and the charge materials, generating intense heat that melts the scrap.

Raw Materials: EAFs primarily use scrap steel as the raw material, making them an efficient choice for recycling steel. They can also use direct reduced iron (DRI) or pig iron produced from iron ore in combination with scrap.

Energy Source: EAFs rely on electricity as the primary energy source to generate the electric arc.

Flexibility: EAFs offer flexibility in terms of steel production, allowing for quick changes in production volumes and steel grades. They are particularly well-suited for producing specialty steels and alloys.

Environmental Impact: EAFs tend to have lower emissions compared to BOFs since they primarily use electricity as the energy source. However, emissions can vary depending on the energy sources used to generate electricity.

Basic Oxygen Furnace (BOF):

Operation: BOFs use a blast of oxygen to convert molten iron from the blast furnace and scrap steel into liquid steel. The oxygen reacts with impurities in the iron to form slag, which is removed, resulting in higher-quality steel.

Raw Materials: BOFs primarily use molten iron from the blast furnace as the primary raw material. They can also use scrap steel in combination with the molten iron.

Energy Source: BOFs primarily rely on oxygen and injected fuels (such as natural gas or coal) for the steelmaking process. The heat generated from the oxidation reactions provides the energy needed to melt the raw materials and maintain the desired temperature.

Production Capacity: BOFs are typically larger in size and have higher production capacities compared to EAFs, making them more suitable for high-volume steel production.

Steel Quality: BOFs are known for producing high-quality steel with low levels of impurities. They are often used for producing commodity steels such as carbon steel and alloy steel.

Environmental Impact: BOFs can have higher emissions compared to EAFs due to the use of injected fuels. However, advancements in technology have led to improvements in environmental performance.

Kalyani Steel process of manufacturing via blast furnace

In summary, both EAFs and BOFs play important roles in steelmaking, with EAFs being favored for recycling scrap steel and producing specialty steels, while BOFs are preferred for high-volume production of high-quality steel. The choice between the two depends on factors such as raw material availability, energy costs, production volume, and desired steel quality

Cost considerations vary between electric arc furnaces (EAFs) and basic oxygen furnaces (BOFs) and can depend on various factors including energy costs, raw material costs, initial investment, and operational expenses. Here's a breakdown of cost considerations for each type of furnace.

Cost factors of Electric Arc Furnaces (EAFs) vs Oxygen blast:

EAF

Initial Investment: EAFs typically require lower initial capital investment compared to BOFs. This is because EAFs can be smaller in size and require less infrastructure, such as the absence of a blast furnace.

Raw Material Costs: EAFs primarily use scrap steel as the raw material, which can be less expensive than the iron ore and coke used in BOFs. However, scrap steel prices can fluctuate depending on market conditions.

Energy Costs: EAFs rely on electricity as the primary energy source. The cost of electricity can vary significantly depending on location, energy provider, and energy source (e.g., fossil fuels, nuclear, renewables). In areas with lower electricity costs or access to renewable energy sources, EAFs may have a cost advantage.

Operating Expenses: EAFs generally have lower operating expenses compared to BOFs. This is because EAFs typically require fewer personnel to operate and maintain, and they have shorter startup and shutdown times, allowing for more flexibility in production scheduling.

Cost factors of Basic Oxygen Furnaces (BOFs):

Initial Investment: BOFs require significant initial capital investment due to their larger size and complex infrastructure. This includes the blast furnace for producing molten iron, oxygen plants for supplying oxygen to the furnace, and associated facilities.

Raw Material Costs: BOFs primarily use molten iron from the blast furnace as the primary raw material. The cost of iron ore, coke, and other materials used in the blast furnace process can fluctuate based on market conditions, potentially impacting the overall cost of steel production.

Energy Costs: BOFs primarily rely on oxygen and injected fuels (such as natural gas or coal) for the steelmaking process. The cost of oxygen and injected fuels can vary depending on market prices and availability.

Operating Expenses: BOFs generally have higher operating expenses compared to EAFs. This is due to the complexity of the process, the need for skilled personnel to operate and maintain the furnace and associated facilities, and longer startup and shutdown times.

In summary, while EAFs may have lower initial capital investment and operating expenses, BOFs may offer advantages in terms of raw material costs and steel quality. The relative cost-effectiveness of each furnace type depends on factors such as energy prices, raw material availability, production volume, and desired steel quality. Additionally, advancements in technology and changes in market conditions can impact the cost competitiveness of both EAFs and BOFs over time.

Gas-Based Direct Reduced Iron (DRI) or Hot-Briquetted Iron (HBI):

Production Process: Gas-based DRI or HBI is produced by using natural gas or other gases containing hydrogen and carbon monoxide to reduce iron ore pellets or lump iron ore in a direct reduction furnace. This process occurs at high temperatures, typically between 800°C and 1050°C, in the presence of a reducing agent. The resulting DRI can be further processed into HBI, which involves compacting the DRI into briquettes and then cooling them.

Advantages:

Higher purity: Gas-based DRI or HBI tends to have a higher purity compared to sponge iron.

Consistency: The process allows for better control over the chemical composition and properties of the DRI or HBI produced.

Lower impurities: The reduction process typically results in lower levels of impurities such as sulfur and phosphorus.

Disadvantages over pig iron:

Energy-intensive: The production of gas-based DRI or HBI requires significant energy input, particularly in the form of natural gas.

Capital-intensive: Setting up gas-based DRI or HBI plants involves considerable capital investment.

Disclaimer:

The content provided in this blog is for educational and informational purposes only. The analysis, opinions, and recommendations presented herein are solely those of the author and do not constitute investment advice or an endorsement of any specific security, strategy, or investment product.

While every effort has been made to ensure the accuracy and reliability of the information provided, the author does not guarantee the completeness or accuracy of the information and assumes no responsibility or liability for any errors or omissions. Readers should perform their own due diligence and consult with a qualified financial advisor before making any investment decisions.

The author is not liable for any losses or damages, including but not limited to financial loss, legal liabilities, or any other consequences arising from the use of or reliance on the information contained in this blog. Investing in stocks and securities involves substantial risk, and it is important to understand these risks before making any investment decisions.

By reading this blog, you acknowledge and agree that the author is not responsible for any decisions you make based on the information provided herein.

Sources:

Annual report of VSSL

Integrated report by Aichi

Conference call transcripts of VSSL